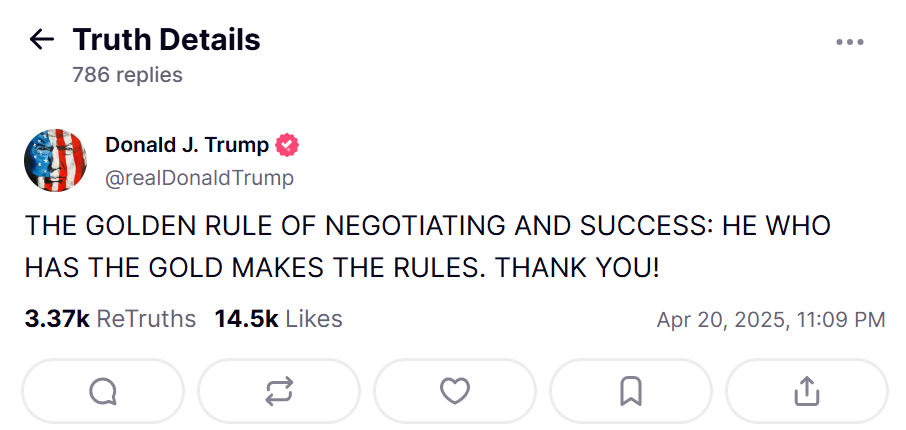

In his April 21, 2025, Truth Social post, Donald Trump declared: “He who has the gold makes the rules.” The financial market responded strongly to this comment, particularly on commodity prices and cryptocurrency values. The statement about the power of wealth through gold was executed as Bitcoin and gold prices simultaneously spiked.

How Did Trump’s Statement Impact the Gold and Bitcoin Price?

Global economic instability prompted Trump to declare his support for Gold during his public announcement. When Trump announced Gold, the financial market reacted by raising gold prices to set a new historical record at $3,384 per ounce. The market gave Bitcoin a major boost, enabling it to surpass multiple resistance zones en route to regaining its $87,500 value.

The Kobeissi Letter interpreted the unusual increase in the prices of gold and Bitcoin as proof that investors increasingly believe an uncertain market climate is developing and that the US dollar may decline.

On a casual Sunday night:

Gold has hit its 55th all time high in 12 months and Bitcoin is officially joining the run, now above $87,000.

The narrative in both Gold and Bitcoin is aligning for the first time in years:

Gold and Bitcoin are telling us that a weaker US Dollar and…

— The Kobeissi Letter (@KobeissiLetter) April 21, 2025

Political events under Donald Trump have increased doubts about the trustworthiness of money based on government authorizations. Many citizens understand Trump’s message as an appeal to overhaul America’s customary financial architecture because the dollar value is falling, and federal debt is increasing rapidly. The concept of Bitcoin’s potential supremacy over traditional financial assets gained momentum after cryptocurrencies gained public attention during the last decade, while gold maintained its economic value storage standing throughout centuries.

Gold Vs BTC: Is Bitcoin the New Gold?

Throughout unstable financial periods, people typically rely on gold to shield their wealth. The limited quantity, historical worth, and moderate market stability make gold favorable to individuals who want market volatility protection. Bitcoin has established itself as one of the main competitors in becoming a safe-haven asset. The digital currency demonstrates similarities to gold through its decentralized structure, limited supply, and acceptance by institutional investors, so it is now being equated to gold.

The current market movements stand out because Bitcoin is not behaving according to its traditional negative connection with the U.S. dollar. Traditionally, Bitcoin displayed an inverse relationship with the dollar value until it exhibited safe-haven assets like gold. Investors see Bitcoin’s decentralized features and independence from central bank control as attractive attributes that offset its ongoing volatility when they want to protect their wealth from currency plummeting and inflation risks.

Trump’s statement probably encouraged the ongoing belief that investors should hold gold along with Bitcoin for portfolio security. Trump emphasized that the holder of physical or digital gold maintains a stronger position during financial uncertainty. Both assets’ simultaneous market growth implies that they serve as separate value stores within expanding international markets instead of competing.

Why Are Investors Turning to Gold and Bitcoin Amid Economic Instability

The economic factors of the situation directly impact the market response to Trump’s statements. Market data shows that the U.S. dollar index achieved its lowest level in three years after two main factors triggered its descent. According to various analysts, Trump’s intermittent positions about influencing the Federal Reserve and economic uncertainty create anxieties, leading to the dollar’s market value decreasing.

there it is: dollar disintegrating and suddenly bitcoin soars $1000 higher to $86750, highest since April 2. Looks like regime shift finally kicked in

Meanwhile, gold surging to fresh record highs

— zerohedge (@zerohedge) April 21, 2025

The present geopolitical tensions, especially toward China, have pushed investors to search for safe assets for their investments. People use Bitcoin as an attractive substitute for stocks and bonds since it transcends geographical boundaries and avoids central bank interference. The rising market value of Bitcoin provides investors with two advantages: portfolio diversification and wealth preservation across economic conditions with an unclear dollar future. According to Trump’s insightful observation, the situation where control of gold means control of power becomes especially vital during dollar currency instability.

Source: Coinfomania / Digpu NewsTex